[Editor’s note: I like getting email from our readers. I don’t always answer, but I appreciate the efforts readers make to express opinions about our articles. This message came to the editor’s email box unsolicited. After reading it I was quite amused; for I too remember the Carter years and the high interest rates of that time. I suspect some of you remember, too!]

Dear Editor,

I’m not telling you my last name. You will understand why as you continue to read. But before I disclose anything, I want to ask you a few questions. Do you have a savings account that pays you interest at an American bank? Or, a checking account? Which? Or both?

Now, about me. I am 78 years old. If I could remember the day I was born, I could tell you that I remember fourteen presidents. Percentage wise, that is nearly one-third of them all. I was married for over a half-century. No children. Living on my pension and social security. I pay taxes. I buy groceries. I use coal-oil in my furnace. I have running water in my house. I watch the news on TV. I get electricity from the pole out front. I quit smoking thirty-five years ago; drinking is no longer a pleasure. I guess my only vice is collecting postcards.

Before the Covid-19 virus, I spent about $500 a month on postcards. I have no one to leave my money to, so I spend my way to happiness. Do you know anyone who can tell you exactly how many postcards are in their collection? I’m not one of them. I have no idea. I keep my cards in four-pocket protective pages. I keep those pages in half-inch binders (otherwise they are too heavy).

There are 25 pages in each of my binders, times eight cards per page. Each shelf in my bookcases will hold 22 binders. 51 shelves. That doesn’t count the shoeboxes (does anyone know how many cards fit in a shoebox?).

So here’s my point. To understand what I’m about to tell you, it would be helpful if you remembered the Carter Administration. I know the 1970s economy was out of control, but a checking account in those years would earn upward of 22% per year. I was younger then, I had been collecting postcards (seriously!) for about five years. I had a few dollars in the bank and the bank paid me interest. I always thought of interest as found money and that I should do something special with it – consequently, I put that “found money” aside and it became my postcard-cash!

Here I am today – more than 40 years have passed. I have a few dollars and the bank still pays me interest. (Granted, they do a little more for me than pay me interest. The bank pays my bills for me. They have super-duper security that protects my money and I guess they do some other things I can’t remember.) There is only one thing different. Today, I have a special postcard savings-account. It too, pays me interest, but much less than I got during the Jimmy Carter years. There have been no postcard shows within driving distance in months, so I have deposited my $500 postcard budget into my special postcard account.

I just received an email from the bank telling me that my statement is ready. My special account balance is now just over $4,000. However, my new balance is still less than $4,001, because the interest paid this month was 7¢.

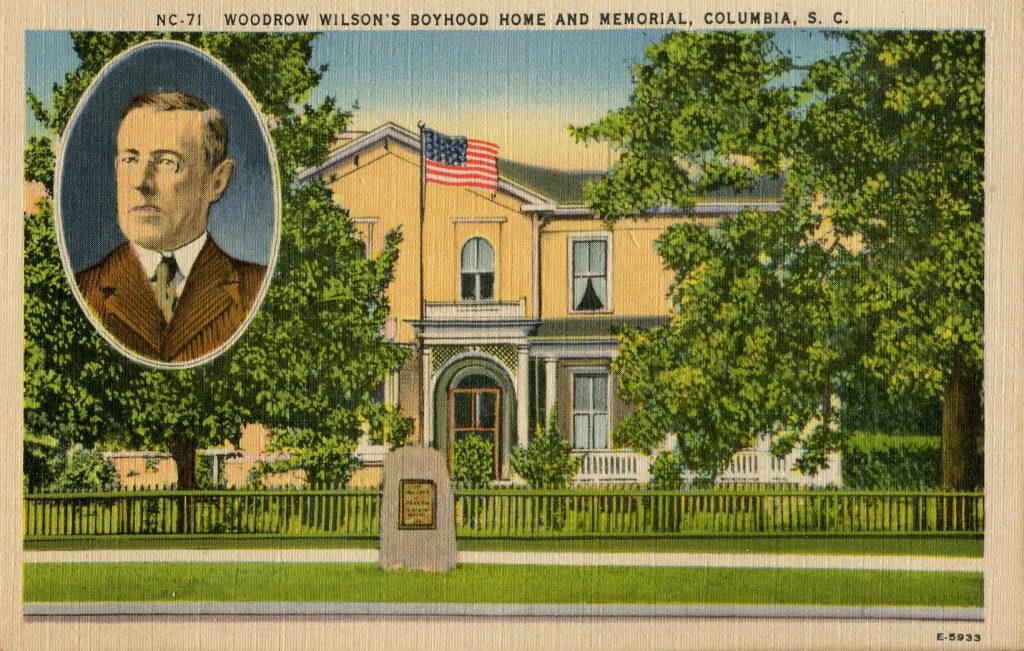

I put the last postcard I purchased with my bank account interest in this note. I have had the card about 25 years. It is a mint-condition card of President Wilson’s boyhood home. I paid $5. If I waited to buy the card with just my interest, it would now be April 2028.

Sometime today, I intend to send this to Postcard History and see if they will publish it. Perhaps there’s a postcard dealer out there in the world who may read this, then sell me a postcard for seven cents.

Thanks for reading,

George

George, I loved your comments. I too remember the Carter Era Interest on my home loan was 21%. With your address I would be glad to send you a card for 7 cents. Happy Collecting. Tony

Took unrealistic interest rates a step further. Took out multiple life insurance policies, borrowed the full amount and turned this over to the bank. Certificates of Deposit paid more than double of what was borrowed. When reality returned to authentic levels, carried over this larger sum for long term compounding while exiting the life insurance arena. Double E bonds matured greatly over 30 years, offering a swell nest egg for retirement.

Large portions have been spent obtaining hobby objects of lust- postcards.

I was born in 1959, so I remember the Carter era as well. High interest rates were great when I had a savings account, but no monthly bills to pay!